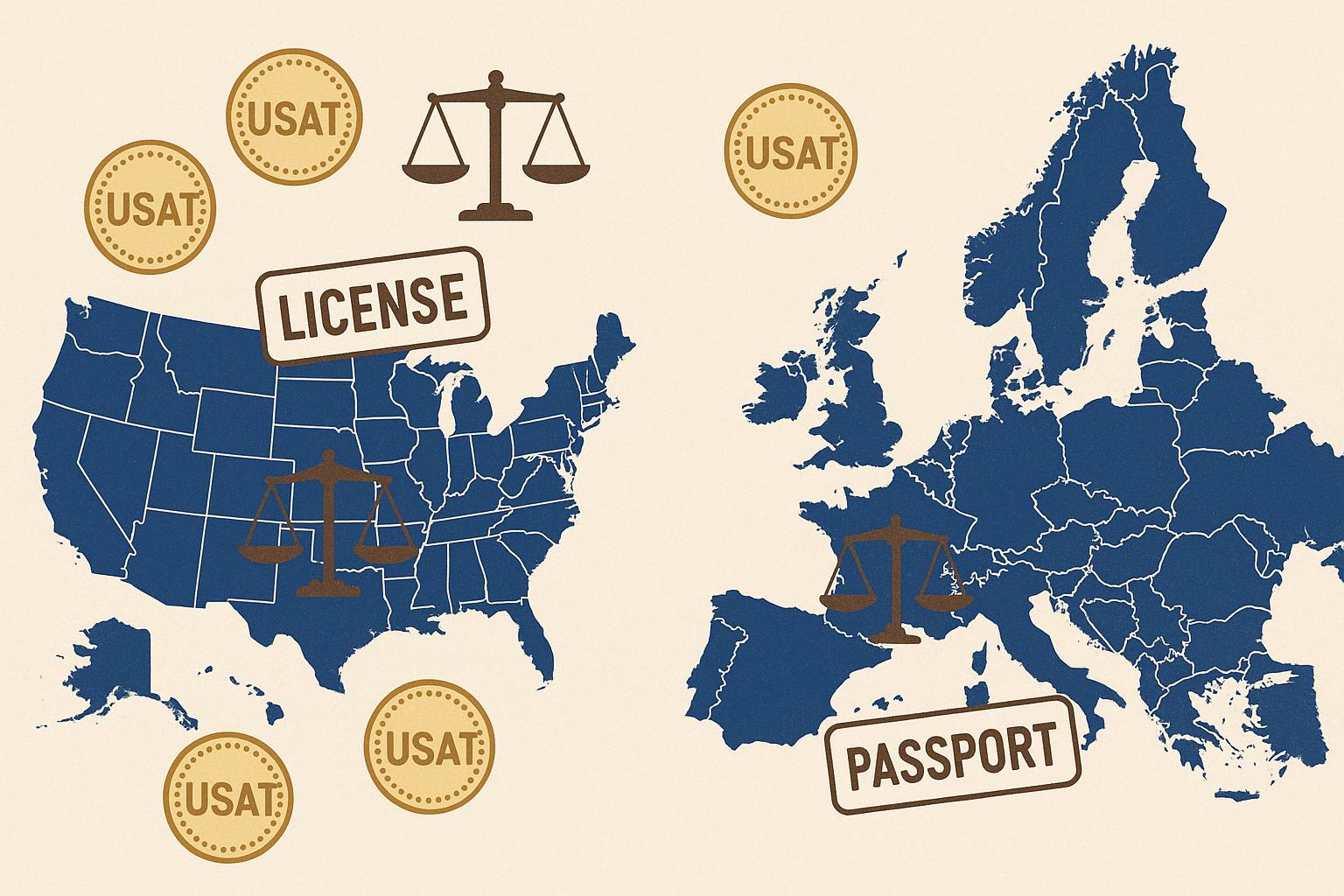

Tether Unveils USAT Under GENIUS Act as Europe Tightens Borderless Crypto Licensing

Washington & Brussels, September 16, 2025 — The global crypto regulation landscape is seeing sharp movements today. Tether, the company behind USDT, announced its latest initiative: a U.S.-issued stablecoin called USAT, structured to comply with the recently enacted GENIUS Act. Meanwhile, in Europe, France has threatened to block the “passporting” privilege for some crypto firms operating under licenses from other EU jurisdictions, citing regulatory arbitrage and concerns over oversight quality.

USAT: Tether's Response to Regulation

Tether’s USAT is designed to be issued domestically, through a regulated U.S. bank, and under full compliance with requirements of the GENIUS Act. The move aims to satisfy regulators calling for stricter reserve backing, audits, and transparent governance for stablecoins. Key motivations include:

- Ensuring Tether retains or grows its U.S. market presence under formal legal frameworks.

- Providing users a stablecoin that aligns with federal regulations rather than operating as a foreign-issuer token.

- Competing with other compliant stablecoins (e.g. USDC) by integrating transparency and compliance from the ground up.

Tether has signaled that USAT will not offer yield initially but will emphasize regulatory compliance and trust. The issuer plans to work under a chartered banking institution to fortify legal and operational legitimacy.

European Regulatory Pushback

In the EU, tension is rising over how crypto firms are using the MiCA (Markets in Crypto-Assets) framework’s license passporting provisions to operate across member states—even when oversight varies significantly across jurisdictions. France, Italy, and Austria are among those pushing for greater supervision by the European Securities and Markets Authority (ESMA) rather than leaving enforcement to individual national regulators. They argue that:

- Some member states have weaker enforcement, creating regulatory “havens”.

- Cross-border risks (cybersecurity, fraud, financial stability) may be insufficiently addressed.

- Central oversight would better ensure uniform standards across the bloc.

Implications for the Stablecoin Market

The two developments together could reshape how stablecoins are issued, used, and regulated. Key takeaways:

- U.S. issuers will increasingly need to align with GENIUS Act standards or risk regulatory obstacles.

- Users and exchanges seeking safe, compliant stablecoins may favor USAT or similarly regulated tokens.

- European regulatory tension might lead to stricter enforcement or amendments in MiCA to tighten passporting rules.

Conclusion

Today marks a potential inflection point in the stablecoin era. Tether’s push with USAT under the GENIUS Act shows how regulation is no longer an afterthought—but a central driver of product strategy. At the same time, Europe’s regulators are signaling that cross-border crypto operations must meet consistent oversight—not just formal licensing.

For stablecoins, crypto markets, and users, this means the days of loosely regulated tokens may be waning. Compliance, trust, and legal clarity are becoming the new currency.

Comments (2)

Web3 Reader

June 16, 2025

Very informative article! I agree that Bitcoin ETFs are a game-changer.

Crypto Enthusiast

June 16, 2025

I wonder how regulations will affect adoption in developing countries.